S-Corporation owners can legally reduce taxes by combining reasonable salary planning, strategic distributions, and depreciation deductions.

However, the biggest tax savings opportunities happen during the year—not at filing time.

As a result, proactive S-Corporation tax planning is the difference between compliance and optimization.

What tax advantages does an S-Corporation provide?

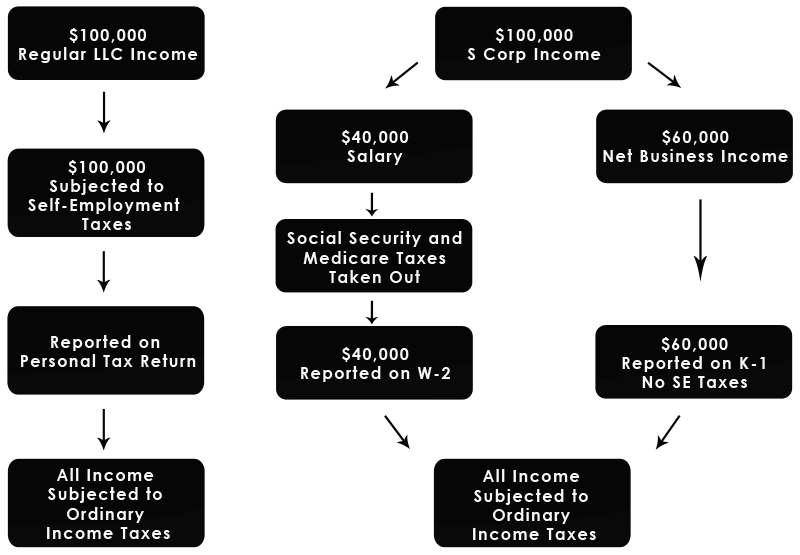

In general, an S-Corporation allows business owners to reduce overall taxes by separating compensation into salary and distributions.

By comparison, S-Corporation income flows through the owner’s personal return while allowing payroll tax flexibility. When structured properly, this can significantly lower self-employment tax exposure.

In practice, the primary tax benefits include:

- Pass-through taxation with no entity-level federal income tax

- Ability to pay owner income partially as distributions not subject to payroll tax

- More planning flexibility for retirement contributions and deductions

- Opportunities to time income and expenses strategically

However, these benefits only work when paired with proactive planning and proper documentation.

Because of this, salary and distribution planning becomes the next critical step.

How should S-Corporation owners structure salary and distributions?

To comply with IRS rules, owners who actively work in the business must receive W-2 wages that reflect market compensation.

In practice, effective salary and distribution strategies involve:

- First, evaluating job duties, experience, and time spent in the business

- Next, comparing industry compensation benchmarks

- Finally, coordinating distributions with cash flow and estimated taxes

At the same time, too little salary increases audit risk, while too much salary increases unnecessary payroll taxes. The goal is defensible balance, not extremes.

Beyond compensation strategy, depreciation deductions offer another powerful way to reduce taxable income.

How do depreciation deductions reduce taxable income?

Specifically, depreciation deductions lower taxable income by allowing businesses to expense qualifying assets over time—or accelerate those deductions when tax law allows.

For example, S-Corporations commonly depreciate:

- Vehicles used for business purposes

- Equipment and machinery

- Computers and technology

- Furniture and office improvements

As part of a broader tax strategy, strategic depreciation planning may include:

- Section 179 expensing for immediate write-offs

- Bonus depreciation when applicable

- Proper asset classification to avoid errors

Because depreciation elections are time-sensitive, planning before purchases occur is critical.

Why does timing matter in S-Corporation tax planning?

The timing of business decisions determines tax savings—not the filing of the return.

Once the year ends

- Payroll amounts cannot be retroactively changed

- Businesses often lose missed depreciation elections once the year closes.

- Owners may already exceed their shareholder basis through distributions.

By contrast, proactive planning allows:

- Income and deductions to be matched intentionally

- Estimated taxes to be calculated accurately

- Cash flow to remain predictable throughout the year

As a result, tax planning becomes a financial strategy rather than a compliance exercise.

What are the most common S-Corporation tax mistakes?

Most S-Corporation tax problems stem from lack of planning, not aggressive behavior.

For this reason, many S-Corporation owners encounter tax problems even when they are trying to do the right thing.

Common issues include:

- Paying no salary or an unreasonably low salary

- Taking distributions without tracking shareholder basis

- Misclassifying personal expenses as business deductions

- Waiting until tax season to ask planning questions

These mistakes often result in higher taxes, penalties, or missed deductions that cannot be corrected later.

Bottom Line

Ultimately, S-Corporation tax savings depend on proactive planning, not last-minute filing.

Reasonable salary, strategic distributions, and depreciation deductions work best when coordinated.

Business owners who plan during the year consistently pay less tax than those who only prepare returns.

With these strategies in mind, professional guidance becomes essential to implement them correctly.

How Madsen and Company Can Help

At Madsen and Company, we work with S-Corporation owners year-round—not just at tax time. Our approach focuses on proactive tax planning that aligns with your business goals while staying fully compliant.

We help S-Corporation owners with:

- Reasonable salary analysis and documentation

- Distribution and basis planning

- Depreciation strategy and asset timing

- Ongoing tax projections and estimated payments

- Business and individual tax preparation

Whether you need tax preparation for S-Corporations or proactive tax planning, the goal is simple: pay the tax you legally owe—and not more.

Frequently Asked Questions (FAQ)

Yes. If the owner performs services for the business, the IRS requires a reasonable salary before distributions are taken.

No. Distributions are not subject to Social Security or Medicare taxes, provided a reasonable salary has already been paid.

Yes. Depreciation deductions can reduce or eliminate taxable income, but losses may be limited by shareholder basis and other rules.

No. While higher profits increase the impact, many S-Corporations benefit once annual profits exceed approximately $50,000–$75,000.

Ideally at the beginning of the year and revisited quarterly, especially before major purchases or income changes.

Ready to Take the Next Step?

If you own an S-Corporation and want clarity instead of surprises at tax time, proactive planning is the next move.

Schedule a tax planning conversation or get help with your S-Corporation tax preparation today.

A clear strategy now can prevent unnecessary taxes later—and that’s where real peace of mind begins.