Updated for the 2025 increase of the SALT deduction cap from $10,000 to $40,000.

📌 Quick Summary

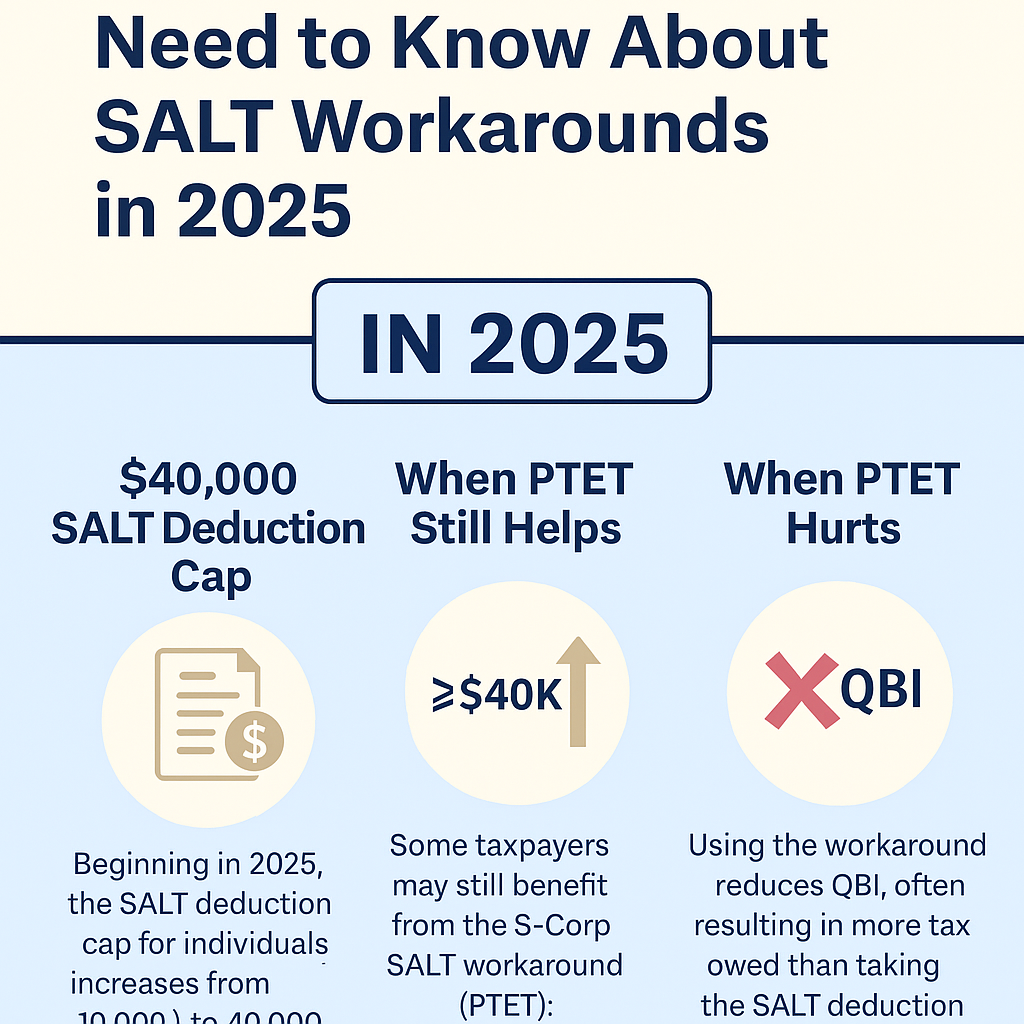

Starting in 2025, the federal SALT (State and Local Tax) deduction cap increases from $10,000 to $40,000. This is a major shift for S-Corp owners who used Utah’s PTET workaround to bypass the previous limit.

With a much higher personal deduction threshold, the PTET workaround becomes less necessary—but still strategically useful in certain cases.

This guide explains when Utah business owners should (and shouldn’t) continue using PTET in 2025.

1. What Is the SALT Workaround for S-Corporations?

During the years when federal SALT deductions were capped at $10,000, states (including Utah) created a workaround called:

Pass-Through Entity Tax (PTET)

This allows an S-Corp to pay the owner’s state income tax at the business level and deduct it as a business expense—avoiding the individual SALT cap.

Example under 2024 rules:

- Utah tax: $15,000

- Individual SALT limit: $10,000

- PTET bypasses the cap

- Entire $15K becomes a business deduction → reduces federal taxable income

This was an extremely valuable strategy for many small business owners.

2. What Changes in 2025?

Beginning January 1, 2025:

The SALT deduction cap increases from $10,000 to $40,000.

This means:

- Most Utah S-Corp owners can now deduct a much larger portion of their state taxes personally

- The PTET workaround becomes optional, not essential

Does PTET go away?

No — Utah still allows PTET.

But the math changes in 2025.

Now the question is:

Does the PTET deduction save more than the QBI deduction it reduces?

For many owners, the answer is no.

3. When PTET Still Makes Sense in 2025

Even with a $40,000 SALT deduction available personally, there are situations where PTET still produces better outcomes.

✔ 1. When your state tax exceeds $40,000

High-income earners may still benefit.

Example:

- State tax owed: $62,000

- Personal deduction cap: $40,000

- Remaining $22,000 is nondeductible personally

- But PTET allows the entire $62,000 to be deducted at the business level

This is still a major PTET advantage.

✔ 2. When you claim the standard deduction

If you do NOT itemize, personal SALT deductions are worthless.

In this case, PTET creates a new business deduction that would otherwise be lost.

✔ 3. When you want to reduce K-1 income

PTET lowers federal K-1 income, which can:

- Reduce federal tax

- Reduce 3.8% Net Investment Income Tax

- Reduce phaseouts tied to AGI

- Improve certain credit qualifications

This remains a planning tool, even in 2025.

4. When NOT to Use PTET in 2025

There are now more situations where PTET hurts more than it helps.

❌ 1. When PTET reduces your QBI deduction

Because:

- PTET reduces K-1 income

- Lower K-1 = lower QBI deduction (20%)

If lowering QBI costs more than the PTET deduction saves → PTET is a bad deal.

This will apply to many small and mid-sized Utah S-Corp owners.

❌ 2. When your Utah taxes fall under the new $40,000 SALT cap

If:

- Your Utah tax < $40,000

- You itemize deductions

Then you can deduct 100% of your state tax personally without reducing QBI.

PTET offers no advantage, and may reduce QBI unnecessarily.

❌ 3. When you already itemize (mortgage, charity, state tax)

If you are already itemizing, a larger SALT cap makes personal deduction more efficient than PTET.

5. Examples: PTET vs Personal SALT Deduction in 2025

📘 Example 1: PTET Helps

- Utah tax: $55,000

- Personal SALT cap: $40,000

- $15,000 would be nondeductible personally

- PTET allows full $55K deduction at entity level

PTET is the better option.

📕 Example 2: PTET Hurts

- Utah tax: $18,000

- Well under the $40K cap

- Owner itemizes

- K-1 income: $150,000

- PTET would reduce K-1 → reduces QBI deduction by ~$3,600

Paying SALT personally is superior.

6. Strategic Recommendation for Utah S-Corp Owners in 2025

Recommended for MOST business owners in 2025:

✔ Pay your state tax personally

✔ Itemize and use the increased $40,000 SALT cap

✔ Preserve the full QBI deduction

Use PTET only when:

- Your state tax exceeds $40K

- You take the standard deduction

- You must lower K-1/AGI for tax purposes

- You’re subject to NIIT or phaseouts

7. Madsen & Company’s Advisory Approach

Because of the new SALT cap, PTET is no longer an automatic strategy.

We now run:

- Side-by-side QBI comparisons

- PTET vs personal SALT deduction analyses

- Itemized vs standard deduction projections

- Full 2025 tax strategy optimization

This ensures you choose the path that minimizes your total tax, not just one line item.

8. Final Takeaway

In 2024, PTET was usually the best choice.

In 2025, the increased SALT deduction changes everything.

For most Utah S-Corp owners, PTET will NOT be the best option in 2025.

But for high-income or high-tax situations, it can still be a powerful tool.

If you want a custom PTET vs SALT analysis for 2025, Madsen & Company can run the numbers and show the exact tax difference.